arizona solar tax credit 2022

The utility company is currently offering a limited-time rebate of 300 per kilowatt-hour kWh up to 3600 for customers who install a home battery and agree to participate in their battery. In Arizona you can claim up to 1000 in tax credits for switching to solar energy.

Earth911 Com On Twitter Installing A Home Solar System Isn T Cheap Learn About The Federal Solar Tax Credit And Other Incentives Intended To Make It More Affordable Sustainability Livegreen Ecofriendly Sustainable Solar Solarpower

This incentive reimburses 25 of your system cost up to 1000 off of your.

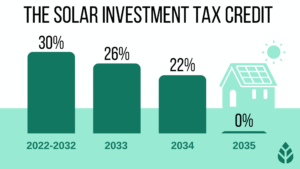

. The biggest incentive remains the federal solar investment tax credit increased to 30 as of August 2022 but Arizona also offers its own state tax credit. In addition to the Residential Clean Energy Credit most Arizona residents are eligible for the state solar tax credit. The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less.

The Solar Investment Tax Credit ITC also known as the Federal Solar Tax Credit allows you to claim 26 of the total cost of installing a solar energy system on your federal taxes. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Income tax credits are equal to 30 or 35 of the investment amount.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. The credit amount allowed against the taxpayers personal income tax is. Arizona Residential Solar and Wind Energy Systems Tax Credit This incentive is an Arizona personal tax credit.

Thats a nice bonus to add to. Individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

This applies to installations in 2022. 2 According to our market research and data from. This means you would be able to enjoy the full benefits of the solar energy system including the Solar Tax Credit and greater return on your investment once you pass the solar payback period.

Applications must be submitted between January 2 and January 31 of the. Arizona Solar Tax Credit. Extended Solar Tax Incentives Through the Inflation Reduction Act signed into law on August 16 2022 the 30 solar tax credit that previously ended in 2021 was reinstated for all residential.

For example if your solar PV system installed in 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as. Federal Solar Tax Credit At the federal level the Investment Tax Credit ITC gives you a credit for 26 of the cost of your solar energy system. In Arizona you can claim up to 1000 in tax credits for switching to solar energy.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. The Arizona Solar Tax Credit makes it more affordable for Arizona residents to purchase a solar system. 23 rows Did you install solar panels on your house.

2022 Extension and Increase of Arizona Solar Tax Credit The House of. The state tax credit is valued at 25 of the total system cost up to a maximum. Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the.

This incentive reimburses 25 of your system cost up to 1000 off of your personal income tax. Approval and certification from the Arizona Department of Revenue is required prior to claiming the tax credit.

Arizona Solar Incentives Tax Credits Rebates Guide 2022

Everything You Need To Know About The Solar Tax Credit

30 Federal Solar Tax Credit A Buyer S Guide 2022

Are Solar Panels Worth It In Arizona Yes Ae Llc

Federal Solar Tax Credit What It Is How To Claim It For 2022

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Average Solar Panel Cost Per Kwh In 2022 Solar Com

Arizona Solar Incentives Tax Credits For 2022 Leafscore

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

What The Inflation Reduction Act Does For Green Energy Pbs Newshour

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Understanding The Utah Solar Tax Credit Ion Solar

The Federal Geothermal Tax Credit Your Questions Answered

Solarize Your Home Maximize Tax Credits Ann Arbor District Library Westgate Branch Sat October 1 2022

2022 Cost To Install Solar Panels In Arizona

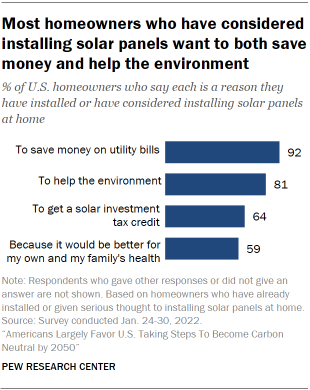

Home Solar Panel Adoption Continues To Rise In The U S Pew Research Center

Texas Solar Incentives And Rebates Available In 2022 Palmetto

New England Solar Power A Guide To Solar Energy In These 6 States Cnet